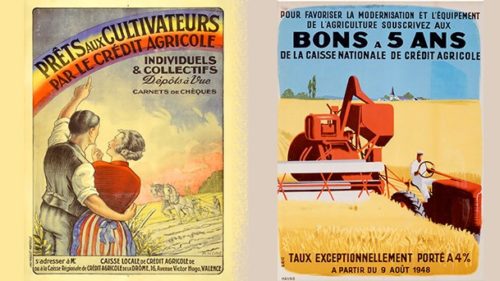

It all began at the end of the 19th century with the Crédit Agricole local banks. Created to make up for the absence of loans suited for farmers, these banks were based on cooperative principles with farm syndicates.

Our commitment was strengthened during the first and second world wars, when we mobilised popular savings and contributed to the post-war reconstruction effort and the mechanisation of farming.

The regional banks further broadened their scope both geographically, by spreading to rural areas, and financially, with loans to small- and medium-sized businesses. Specialised subsidiaries were created: Union d’Études et d’Investissements was created for equity investments, Segespar for asset management and Unicrédit for loans to agri-food businesses.

We also became the bank for housing and households, thus marking our close relationship with our customers.

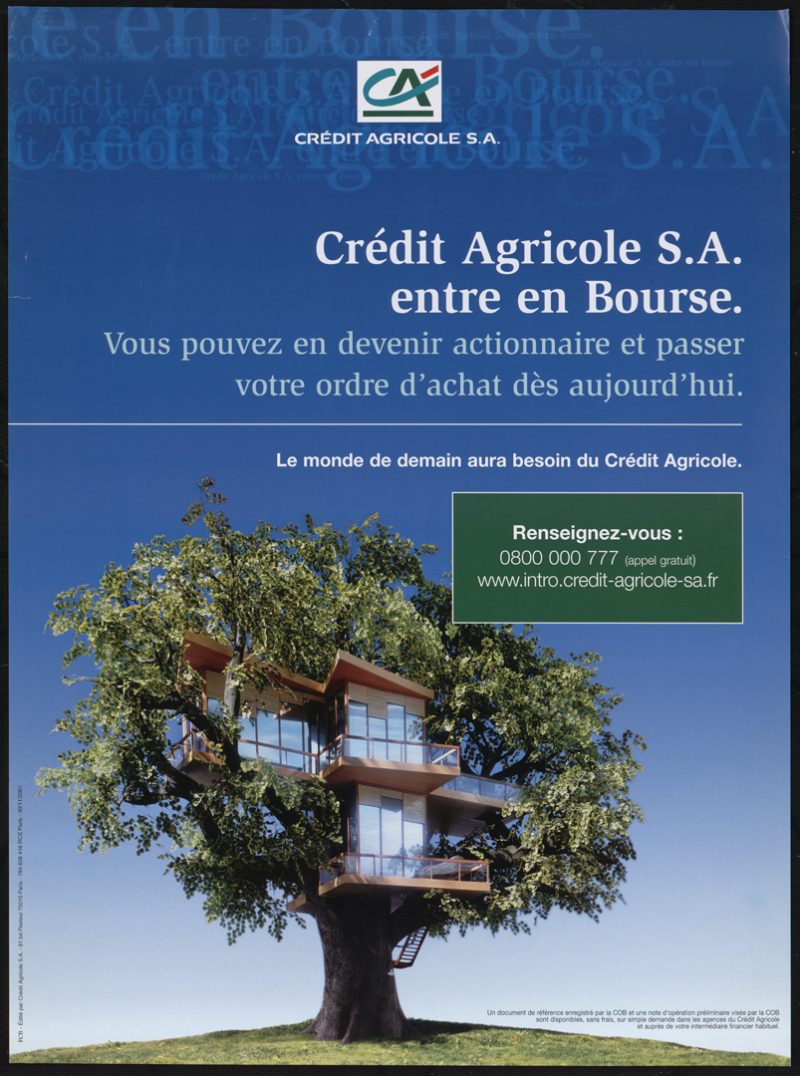

In 1979, our financial strength was recognised and we were able to expand internationally with our first operations outside France. The Banker magazine ranked Crédit Agricole among the world’s leading banks.